Guide to Nordea Bank SWIFT Codes in Denmark

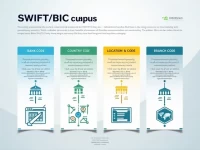

This article explains how to obtain the SWIFT code for the Nordea Dansk branch in Denmark, providing detailed information about each branch. It emphasizes the importance of using the correct SWIFT code in international remittances and outlines how to ensure the safety and accuracy of funds.